What Does Eb5 Investment Immigration Mean?

Table of ContentsExamine This Report about Eb5 Investment ImmigrationAn Unbiased View of Eb5 Investment ImmigrationHow Eb5 Investment Immigration can Save You Time, Stress, and Money.Rumored Buzz on Eb5 Investment Immigration10 Easy Facts About Eb5 Investment Immigration Described

While we aim to provide accurate and current content, it ought to not be taken into consideration lawful guidance. Migration regulations and policies go through change, and private circumstances can vary widely. For personalized support and legal guidance regarding your particular migration circumstance, we strongly suggest consulting with a qualified migration attorney that can supply you with customized support and make certain conformity with current laws and regulations.

Citizenship, via investment. Currently, as of March 15, 2022, the amount of investment is $800,000 (in Targeted Employment Locations and Backwoods) and $1,050,000 somewhere else (non-TEA zones). Congress has accepted these amounts for the next five years beginning March 15, 2022.

To receive the EB-5 Visa, Financiers should produce 10 full time U.S. work within two years from the day of their complete financial investment. EB5 Investment Immigration. This EB-5 Visa Need ensures that financial investments add directly to the U.S. task market. This uses whether the jobs are developed directly by the business venture or indirectly under sponsorship of a designated EB-5 Regional Facility like EB5 United

Not known Incorrect Statements About Eb5 Investment Immigration

These work are identified through designs that use inputs such as advancement expenses (e.g., building and construction and devices expenses) or annual earnings generated by recurring operations. In contrast, under the standalone, or direct, EB-5 Program, only direct, full-time W-2 employee placements within the commercial business might be counted. A crucial threat of counting only on direct workers is that personnel reductions because of market conditions might result in insufficient full-time placements, potentially causing USCIS rejection of the financier's request if the work production requirement is not met.

The financial model then forecasts the variety of straight jobs the new business is likely to produce based on its awaited earnings. Indirect work determined with economic versions describes employment produced in markets that provide the items or solutions to business straight associated with the project. These work are produced as a result of the boosted need for items, materials, or solutions that support business's procedures.

How Eb5 Investment Immigration can Save You Time, Stress, and Money.

An employment-based fifth preference classification (EB-5) financial investment visa provides a technique of ending up being a long-term U.S. homeowner see this website for foreign nationals intending to invest funding in the United States. In order to use for this environment-friendly card, a foreign investor has to invest $1.8 million (or $900,000 in a Regional Facility within a "Targeted Work Location") and create or protect at the very least 10 permanent work for United States workers (leaving out the capitalist and their immediate family).

Today, 95% of all EB-5 resources is raised and invested by Regional Centers. In lots of areas, EB-5 financial investments have actually loaded the financing void, providing look at more info a new, important source of continue reading this funding for neighborhood economic growth projects that renew neighborhoods, produce and sustain tasks, infrastructure, and solutions.

The Ultimate Guide To Eb5 Investment Immigration

Even more than 25 nations, including Australia and the United Kingdom, usage comparable programs to attract foreign investments. The American program is much more rigorous than many others, calling for significant risk for financiers in terms of both their financial investment and immigration status.

Families and people that seek to move to the United States on an irreversible basis can use for the EB-5 Immigrant Capitalist Program. The United States Citizenship and Immigration Solutions (U.S.C.I.S.) established out different needs to get long-term residency via the EB-5 visa program.: The initial step is to find a qualifying financial investment chance.

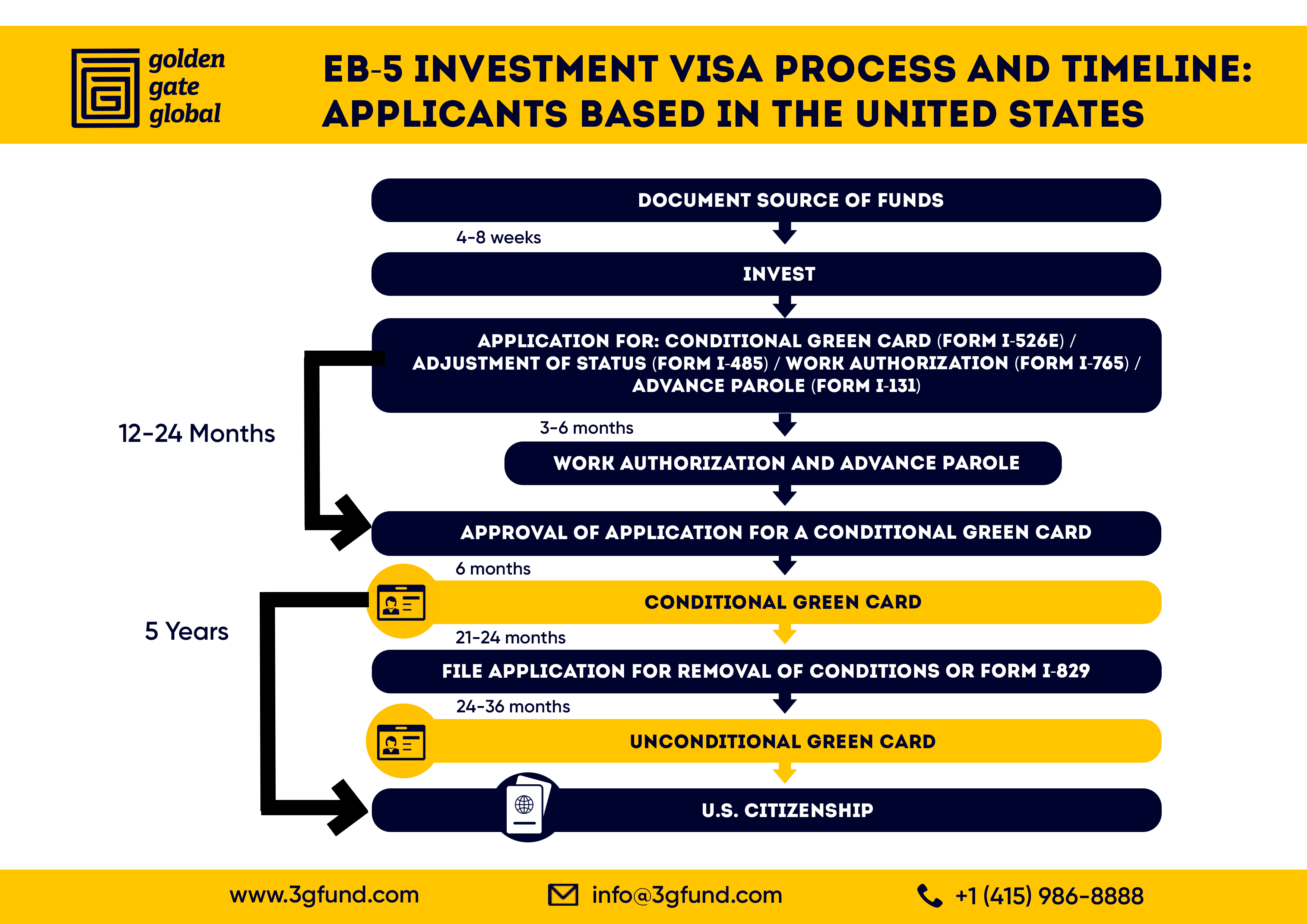

Once the possibility has been determined, the investor should make the financial investment and submit an I-526 request to the U.S. Citizenship and Migration Services (USCIS). This request must consist of evidence of the financial investment, such as financial institution declarations, purchase arrangements, and business plans. The USCIS will certainly evaluate the I-526 application and either accept it or demand additional proof.

The smart Trick of Eb5 Investment Immigration That Nobody is Talking About

The investor needs to make an application for conditional residency by submitting an I-485 application. This request has to be sent within six months of the I-526 approval and need to consist of proof that the investment was made which it has actually produced a minimum of 10 permanent work for united state workers. The USCIS will review the I-485 petition and either approve it or request added proof.